Accounts Receivable Outsourcing Services

Improve Cash Flow | Reduce Outstanding Dues | Accelerate Business Growth

Managing accounts receivable (AR) efficiently is critical for maintaining healthy cash flow. Delayed payments and overdue invoices can affect profitability, hinder business growth, and create financial instability.

At FintechBooks, we specialize in end-to-end accounts receivable outsourcing solutions that help businesses collect payments faster, minimize bad debts, and improve financial efficiency. Our expertise in AR management ensures smooth invoicing, follow-ups, and collection processes so you can focus on scaling your business.

📌 Our AR accounting processes comply with:

✅ IND AS (Indian Accounting Standards)

✅ IFRS (International Financial Reporting Standards)

✅ US GAAP (Generally Accepted Accounting Principles, USA)

🚀 Reduce Payment Delays | Improve Collections | Strengthen Financial Health

Key Features of Our AP Outsourcing Services

Streamlined Collection Process

Get paid on time with structured follow-ups

Reduced Bad Debts

Identify and manage overdue accounts effectively

Automated Invoicing & Payment Reminders

Stay ahead with timely reminders

Improved Credit Risk Management

Monitor and assess customer payment behavior.

Compliance with IND AS, IFRS & US GAAP

Compliance with IND AS, IFRS & US GAAP

Scalable & Cost-Effective

Adapt to changing business needs without infrastructure investment

We act as an extension of your finance team, ensuring seamless AR operations without the hassle of

managing collections in-house.

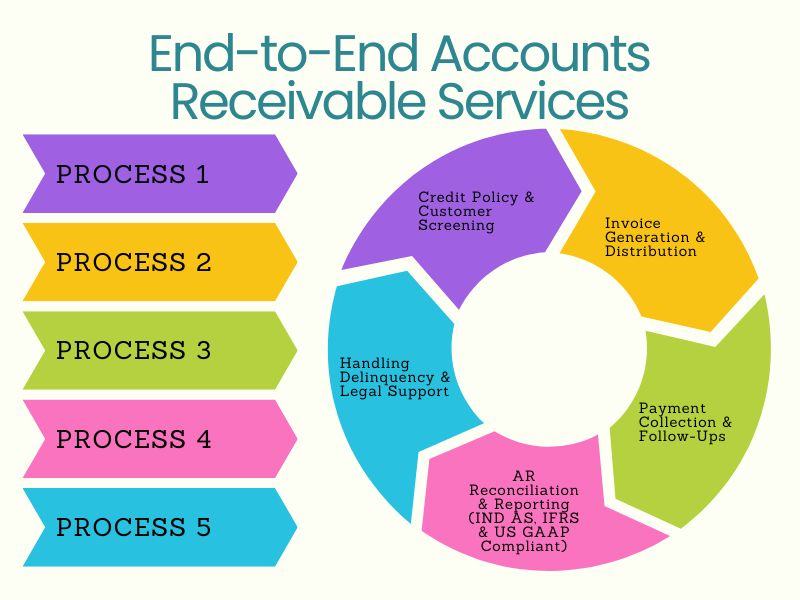

Our End-to-End Accounts Receivable Services

1. Credit Policy & Customer Screening

A clear credit policy helps businesses maintain control over receivables. We assist in:

✔ Setting up customer credit terms & policies

✔ Assessing creditworthiness before extending credit

✔ Monitoring customer payment behavior & credit risks

2. Invoice Generation & Distribution

A well-structured invoice system ensures prompt payments. We handle:

✔ Electronic invoicing (E-invoicing) for faster processing

✔ Automated invoice tracking & follow-ups

✔ Customized billing solutions for different payment terms

3. Payment Collection & Follow-Ups

Timely collections are crucial to avoid cash flow disruptions. We offer:

✔ Automated reminders & follow-ups for overdue payments

✔ Multiple payment options for customer convenience

✔ Dispute resolution & escalation support

4. AR Reconciliation & Reporting (IND AS, IFRS & US GAAP Compliant)

We ensure accurate financial records and compliance with accounting standards:

✔ Ledger reconciliation to prevent errors

✔ Regular AR aging reports to track outstanding dues

✔ Financial reporting in compliance with IND AS, IFRS & US GAAP

✔ Bad debt provision & write-off management

5. Handling Delinquency & Legal Support

Managing overdue accounts requires a proactive approach. We assist with:

✔ Early identification of delinquent accounts

✔ Collection strategies for high-risk customers

✔ Legal follow-up & recovery action if needed

The FintechBooks Advantage

Faster Collections & Improved Cash Flow

• Structured follow-ups reduce average collection time.

• Digital invoicing and automated payment reminders ensure timely payments.

Cost Savings & Scalability

• Avoid hiring and training in-house AR teams.

• Scale up or down based on business needs.

Compliance & Risk Mitigation

• Ensure compliance with IND AS, IFRS & US GAAP.

• Implement internal controls to prevent revenue leakages.

24/7 Transparency & Control

• Access real-time reports & analytics.

• Stay updated on collection status & AR performance.

AR Audit Checklist – Ensuring Compliance with IND AS, IFRS & US GAAP

Auditing accounts receivable is essential for financial transparency. Here’s what our AR audits cover:

✅ Invoice Verification: Ensuring invoices are correctly issued and recorded.

✅ Ledger Matching: Cross-checking AR reports with general ledger entries.

✅ Overdue Account Review: Identifying high-risk and long-overdue accounts.

✅ Bad Debt Provisions (IND AS 109, IFRS 9, US GAAP ASC 326): Evaluating doubtful debts and write-offs.

✅ Customer Payment Analysis: Understanding trends in delayed payments.

✅ Compliance Check: Ensuring adherence to IND AS, IFRS & US GAAP reporting standards.

Our audit-ready AR reports help businesses maintain accurate records and avoid financial discrepancies.

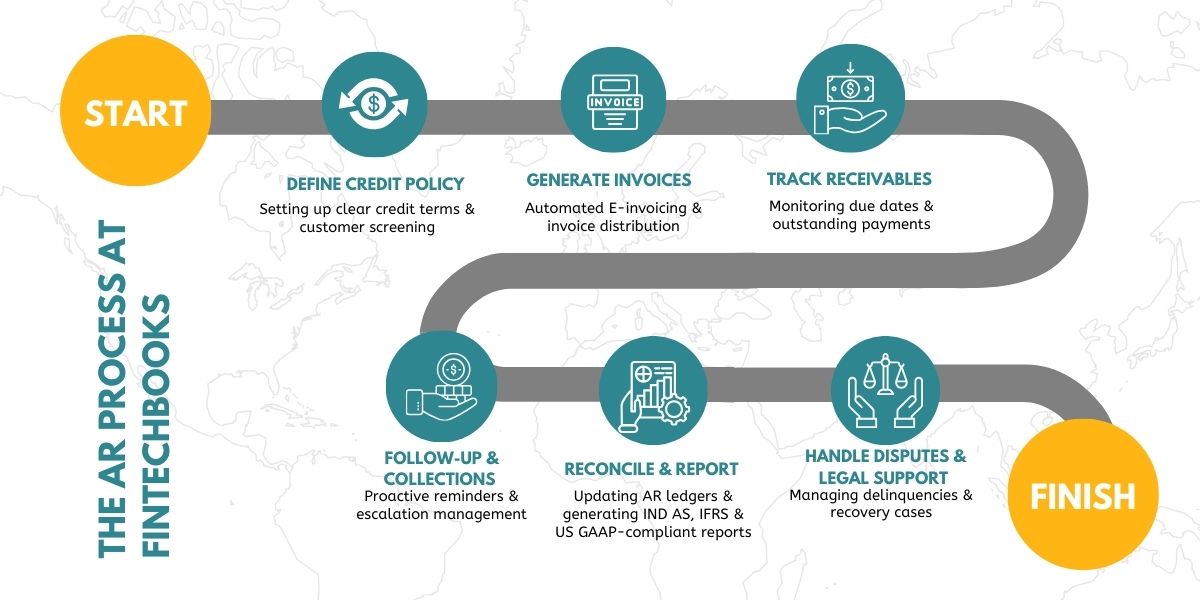

The AR Process at FintechBooks

A well-structured AR process ensures faster collections, reduced bad debts, and improved cash flow. Here’s how we handle it:

🎯 Outcome: Faster collections, lower outstanding dues, and a healthier balance sheet.

Get in Touch

📌 Want to improve cash flow & minimize bad debts? Our expert team is here to help!

🔹 Schedule a Free Consultation Today!