Driving Growth Through Strategic Financial Leadership – Without the Full-Time Overhead

In today’s hyper-competitive and rapidly evolving business environment, financial agility isn’t just an advantage—it’s a necessity. Strategic financial leadership plays a pivotal role in steering organizations toward sustainable growth, profitability, and resilience. Yet, for many businesses, the cost and commitment of hiring a full-time Chief Financial Officer (CFO) can be a barrier.

That’s where Fintechbooks Virtual CFO Services transform the way businesses manage their finances.

Our Virtual CFO solutions give you on-demand access to board-level financial expertise—providing the vision, strategy, and analytical depth of an in-house CFO, without the fixed cost burden. We work as an extension of your leadership team, designing tailored financial roadmaps, optimizing cash flow, strengthening compliance, and enabling data-driven decision-making that accelerates growth.

Whether you’re scaling a startup, navigating complex regulatory landscapes, entering new markets, or seeking to enhance profitability, our Virtual CFOs bring the strategic insight and operational discipline needed to turn financial challenges into opportunities.

Virtual CFO Services

At Fintechbooks, our Virtual CFO services deliver the strategic financial leadership your business needs—without the cost of a full-time executive. We manage the full spectrum of finance functions, including accounting, bookkeeping, financial planning, legal compliance, MIS reporting, strategic advisory, payroll, and operations—ensuring your organization runs efficiently and profitably.

Our CFO experts work as an extension of your leadership team, implementing best-in-class processes that optimize financial performance, strengthen compliance, and unlock new growth opportunities. From building robust financial systems for startups, to scaling operations for MSMEs, to streamlining complex finance structures for large enterprises, we provide the tools and expertise to help you succeed at every stage.

Whether you need to establish strong financial controls, improve cash flow management, prepare investor-ready reports, or drive data-backed decision-making, our Virtual CFO solutions empower you to focus on growth while we handle the financial complexity.

With Fintechbooks, you don’t just get outsourced finance support-you gain a strategic partner committed to maximizing revenue, minimizing risk, and future-proofing your business.

Our Virtual CFO Services Include

Financial Planning and Analysis

In a business world driven by data and rapid market shifts, financial decisions can’t rely on hindsight—they demand foresight. At Fintechbooks, our Financial Planning and Analysis (FP&A) services are designed to equip your business with predictive insights, scenario modelling, and real-time performance tracking that fuel smarter, faster, and more profitable decisions.

We don’t just prepare budgets—we create dynamic, AI-enabled financial models that adapt to changing market conditions, enabling you to anticipate challenges before they arise and capitalize on emerging opportunities. From revenue optimization and margin improvement to risk mitigation and investment planning, our FP&A framework ensures you stay in control of your financial future.

By combining deep financial expertise with advanced analytics, we help you move beyond traditional reporting to a future-ready strategy—where every decision is guided by accurate forecasting, actionable intelligence, and a clear path to growth.

With Fintechbooks as your FP&A partner, you’re not just tracking performance—you’re shaping it.

Budgeting and Forecasting

In today’s fast-moving business landscape, static budgets and outdated forecasts can quickly become irrelevant. At Fintechbooks, our Budgeting and Forecasting services go beyond spreadsheets—we deliver dynamic, data-driven financial planning that keeps you agile, informed, and ahead of the curve.

We combine advanced analytics, scenario modelling, and real-time performance tracking to create budgets and forecasts that evolve with your business. Whether it’s adjusting to market volatility, managing cash flow with precision, or aligning spending with strategic priorities, our approach ensures your financial plan remains a living, responsive tool-not a one-time exercise.

By leveraging intelligent forecasting methods, we help you anticipate revenue shifts, optimize resource allocation, and identify potential risks before they impact performance. The result? A clear, adaptable roadmap that empowers confident decision-making at every stage of growth.

Cash Flow Management

Cash flow is the lifeblood of any business-and in an unpredictable market, managing it effectively is the difference between thriving and merely surviving. At Fintechbooks, our Cash Flow Management services are designed to give you complete visibility, control, and confidence over your liquidity.

We go beyond traditional monitoring, leveraging advanced forecasting tools, real-time analytics, and trend analysis to predict cash inflows and outflows with precision. This proactive approach enables you to plan for seasonal fluctuations, meet operational demands, fund growth initiatives, and cushion against unforeseen disruptions.

Our team works closely with you to optimize receivables, streamline payables, and balance working capital—ensuring that your resources are always deployed strategically. By identifying bottlenecks and uncovering hidden opportunities, we help you maintain financial agility and strengthen long-term stability.

Financial Reporting and Compliance

In a world of evolving regulations and heightened scrutiny, accurate financial reporting and strict compliance aren’t just obligations-they’re competitive advantages. At Fintechbooks, our Financial Reporting and Compliance services ensure your business meets every regulatory requirement while equipping you with clear, actionable insights into your financial performance.

We combine deep regulatory expertise with advanced reporting tools to deliver precise, timely, and audit-ready financial statements. Our approach goes beyond basic compliance-transforming your reports into strategic assets that highlight key performance indicators, uncover trends, and inform high-impact business decisions.

From adhering to local and international accounting standards to preparing for audits and regulatory reviews, we help you stay fully compliant while minimizing risk exposure. With our proactive monitoring and governance frameworks, you can navigate complex regulations with ease and focus on driving growth.

Business Performance Monitoring

In a fast-changing business environment, performance monitoring is no longer a quarterly review—it’s a continuous, data-driven process. At Fintechbooks, our Business Performance Monitoring services give you real-time visibility into your company’s financial health, empowering you to make timely, informed decisions that keep you ahead of the competition.

We track critical KPIs, financial ratios, and operational metrics using advanced analytics dashboards that transform raw data into actionable intelligence. This allows you to quickly identify strengths, pinpoint underperforming areas, and adapt strategies before small issues become costly setbacks.

Our proactive approach ensures your business stays aligned with its goals, market opportunities, and evolving challenges. Whether it’s improving profitability, optimizing efficiency, or driving sustainable growth, our monitoring framework keeps your business on the right trajectory.

With Fintechbooks, you’re not just measuring performance—you’re mastering it.

Know More About Our Virtual CFO Services

Key Benefits Of Virtual CFO Services

Strategic Financial Planning

The creation of financial strategies that align with your business objectives, ensuring sustainable growth and long-term profitability. At Fintechbooks, we focus on designing clear, actionable plans that keep your finances on track, support informed decision-making, and strengthen your overall business performance.

Cash Flow Management

Critical analysis and optimization of cash flow to ensure your business has the necessary funds to operate efficiently and support growth. At Fintechbooks, we focus on maintaining liquidity, improving working capital, and enhancing overall operational efficiency.

Budgeting and Forecasting

Developing detailed budgets and financial forecasts is a core responsibility of Fintechbooks Virtual CFO services. This process enables us to anticipate the outcomes of financial decisions, assess potential risks, and make informed, well-reasoned choices that support sustainable growth.

Financial Reporting and Analysis

Providing detailed financial reports and interpreting the data to deliver valuable business insights, enabling better decision-making and a clear understanding of the company’s financial health. At Fintechbooks, we turn numbers into actionable intelligence that supports growth and stability.

Risk Management and Compliance

Identifying potential financial risks, ensuring full adherence to all relevant regulations and standards, and safeguarding the company’s interests. At Fintechbooks, we proactively manage risks and maintain compliance to protect your business and strengthen its long-term resilience.

Investment and Capital Management

Advising on strategic investment opportunities and optimal capital allocation to achieve the highest returns while supporting sustainable business growth. At Fintechbooks, we ensure every financial move is aligned with long-term value creation.

Improving ROI Using Automation

Leveraging the right automation tools to streamline labor-intensive financial processes such as MIS reporting, payroll, and reconciliation. At Fintechbooks, our Virtual CFOs use automation to boost efficiency, reduce costs, and maximize return on investment.

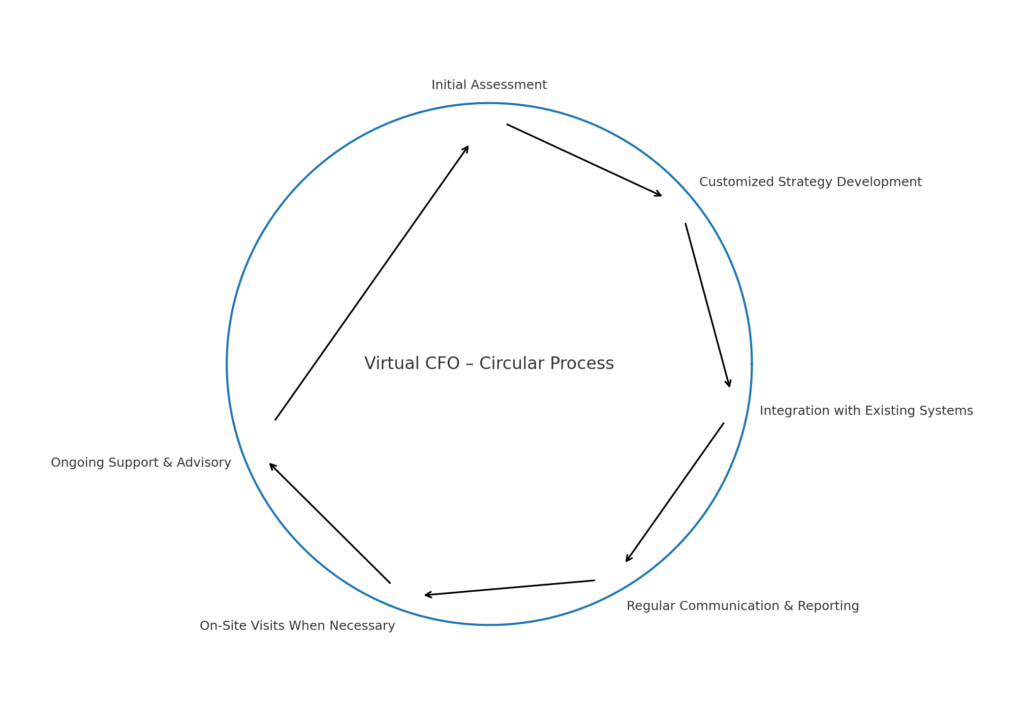

How Does Virtual CFO Services Work?

Initial Assessment

The process begins with a thorough evaluation of your business’s financial position, including in-depth analysis of statements, understanding the core business model, and identifying critical financial challenges. At Fintechbooks, this step is designed to set a strong foundation for long-term resilience, adaptability, and success in an evolving global market.

Customized Strategy Development

Based on the assessment findings and the level of engagement required, we create a tailored strategy that addresses every aspect of your financial operations—from daily accounting processes to long-term financial planning. At Fintechbooks, these strategies are built to adapt to market changes, leverage emerging technologies, and ensure sustainable growth well into the future.

Integration with Existing Systems

Our Virtual CFOs seamlessly integrate with your current financial systems and workflows, implementing cloud-based accounting platforms, digital transformation tools, and advanced RPA and AI technologies. This ensures smooth data flow, enhanced accuracy, and real-time financial visibility—positioning your business for agility and innovation in the decades ahead.

Regular Communication and Reporting

Consistent communication is vital to financial success. Our Virtual CFOs hold scheduled weekly or monthly meetings to review performance, address upcoming challenges, and explore strategic opportunities. We provide real-time dashboards and detailed reports, ensuring you have instant visibility into your financial position and the insights needed to act decisively.

On-Site Visits When Necessary

While most interactions are handled virtually, our Virtual CFOs conduct on-site visits for key meetings, critical reviews, and situations where in-person involvement is essential. This ensures important discussions, strategic decisions, and process evaluations receive the focused attention they require.

Ongoing Support and Advisory

Virtual CFOs provide continuous support, adapting to your business’s evolving needs. They offer strategic guidance on key financial decisions, investment opportunities, and growth initiatives, ensuring your company remains agile, competitive, and financially sound.

Spend More Time On Building Your Business, Leave Your Finances To Us

At Fintechbooks, we deliver advanced Virtual CFO solutions tailored for SMEs, startups, and fast-growing enterprises. Our on-demand CFO experts streamline accounting, compliance, and financial strategy using next-gen tools and data-driven insights — so you can focus on innovation, scaling, and achieving your business vision.

Get a Free Consultation | Explore Virtual CFO Services

Trusted by finance teams & founders — accounting, cashflow, compliance, MIS reporting, strategic advisory and automation handled end-to-end.

If you’ve been sensing that something is missing in your business despite having well-managed accounts and books, it’s likely the strategic insight and guidance of a seasoned finance leader that you need to unlock your next phase of growth.

At Fintechbooks, we provide on-demand veteran CFOs on a monthly retainer who work closely with your in-house finance team to identify gaps, uncover opportunities, and deliver strategic guidance through a sharp financial lens.

Insightful Monthly MIS

Our MIS is designed for effective tracking and decision-making. At Fintechbooks, our Virtual CFO partners review financial and operational metrics, map them to key business drivers, and design intelligent dashboards that deliver clear, actionable insights. We produce concise, insightful reports each month and create SOPs to ensure consistent, reliable reporting across the organisation.

Cash Flow Management

Optimizing cash flow is essential for sustaining business agility and operational excellence. Through intelligent management of receivables and payables, our outsourced CFO partners assess assets and liabilities, implement liquidity optimization strategies, and strengthen credit risk controls to safeguard stability and maximize operational efficiency.

Top & Bottom Line Improvement

Our next-generation Virtual CFO solutions integrate predictive analytics, AI-driven pricing models, and real-time market intelligence to strategically boost your topline. By leveraging advanced customer profitability mapping, dynamic competition tracking, and segment-based growth strategies, we ensure sustained revenue expansion. For the bottom line, we apply inflation impact simulations, automated cost optimization, and smart tax-depreciation algorithms to safeguard margins and accelerate long-term profitability.

Investor Relationship & Reporting

Our Virtual CFO partners strengthen investor relationships by delivering transparent, data-rich, and real-time performance reports. Using AI-powered analytics and predictive insights, we transform financial and operational data into clear, actionable intelligence for current and potential shareholders. This proactive reporting fosters trust, supports informed decision-making, and positions your business for long-term market confidence.

Manage Accounting Policies & Procedures

Our Virtual CFO partners design and implement intelligent, technology-driven accounting policies and procedures that strengthen internal controls and enhance governance. By integrating AI-powered compliance checks, automated workflow approvals, and cloud-based documentation, we ensure financial processes remain agile, transparent, and fully aligned with evolving global standards—empowering your business to scale securely and efficiently.

Internal Control

Our Virtual CFOs architect tailored internal control frameworks that evolve with your business size, industry, and growth stage. Leveraging AI-driven monitoring, real-time analytics, and blockchain-enabled audit trails, we ensure absolute accuracy of financial data while proactively managing risks. This not only safeguards assets but also boosts operational efficiency, driving sustained performance and investor confidence.

Compliance

Our Virtual CFO solutions deliver end-to-end compliance management, seamlessly covering company law, taxation, labor regulations, foreign exchange norms, and loan covenants. Leveraging AI-driven monitoring tools and automated alerts, we ensure your business stays ahead of evolving regulations. Our proactive approach minimizes risk, ensures timely filings, and safeguards your credibility in a rapidly changing global compliance landscape.

ERP Implementation

Our Virtual CFO partners assess, design, and implement next-gen ERP systems that unify data, workflows, and processes across your organization. By leveraging cloud-based platforms, AI-driven analytics, and RPA integration, we help you accelerate product movement, process orders instantly, automate invoicing, reconcile consignments in real-time, and optimize collections. This future-ready ERP approach boosts productivity, improves decision-making, and ensures operational agility for the next 25 years of growth.

Let’s Build Your Success Story Together!

FinTech Books

- +91 9990 197 404

- Info@fintechbooks.in

- #582, Sector 42, Gurugram